Home

Featured

- Returning To The Burning

- Things I Would Like To Do In 2026

- The Road Beyond 28 Million Viewers

- Risk-Based Strategy for Sustainable Investment

- Term Paper: Philosophical Issues in Artificial Intelligence

- Phenomenal Consciousness: Between the Lines of Experience and Representation

- The Cuisinart Gluten Free Bread Maker Is Great

- My New NAS Architecture: DIY Synology Running RAID 51

- Current Gear List

- How To Set Up A Plex NAS

Adventures

- Big Bend National Park

- Current Camping Gear List

- Northeasternmost Point

- Lobster Rolls at Geddy’s in Bar Harbor

- Acadia National Park

- Holy Donut in Portland, Maine!

- American History Sites: Civil War Megapost

- American History Sites: Revolutionary War Megapost

- New Haven Style Clam Pizza at Modern Apizza

- Trowbridge Square Park (Family History)

Reading List

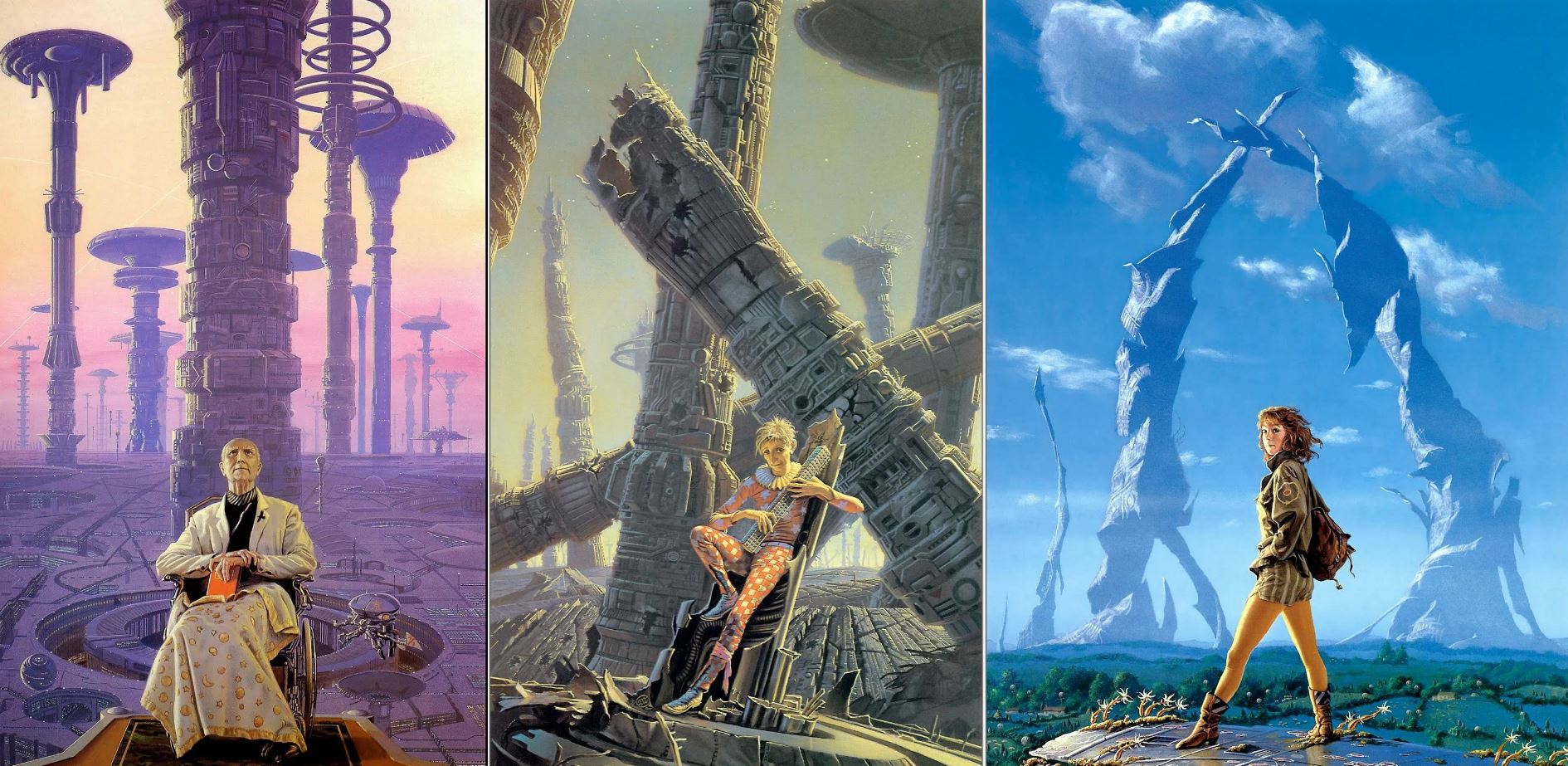

- Dune 3: Children of Dune

- Dune 2: Messiah

- Dune 1

- Expanse 7.5 – Auberon

- Expanse 9 – Leviathan Falls

- Jonny Appleseed by Joshua Whitehead

- The Broken Earth Trilogy by N. K. Jemisin

- Thrawn Ascendancy: Greater Good (Thrawn 10)

- All Tomorrow’s Parties by William Gibson

- Idoru by William Gibson

Essays

- Term Paper: Philosophical Issues in Artificial Intelligence

- Phenomenal Consciousness: Between the Lines of Experience and Representation

- All of California’s agricultural land is fundamentally unsustainable and structurally self-destructive.

- The Black Box That Reflects Its Maker

- On Indigenous Epistemology and Ethics

- Resisting Pressure to Conform To Capitalist Hegemony

- Choosing to be Queer Native or Native Queer

- Collective Ownership is Key

- Seize Housing Now

- Urban poverty is Not an Accident

Pages

- A Year In The Wilderness

- Book Clubs

- Burning Man

- Logistics-Based Strategy in Resource Sovereignty

- Queerantine Book Club: Gender Trouble by Judith Butler

- Spring Break 2018 in Europe

- Sustainability Economics

- The Levels Challenge: Build 12 Startup Products in 12 Months

Categories

- All Posts

- 2018 Burn

- 2019 Burn

- 2020 Burn

- 2025 Burn

- AIS 440 Native Sexuality and Queer Discourse

- AIS460 Power and Politics in American Indian History

- Adventures

- Advice

- Analysis

- BUS 884: Ethics, Society, and Sustainability

- Blog

- Burners Without Borders SF

- Burning Man

- C&J Big Queer Tent

- Content Business

- Current Projects

- DC

- DS 786 Operations Analysis

- ECON 783 Managerial Economics

- EDC

- ETHS 100 Intro to Ethnic Studies

- Empathy Podcast

- Essays

- FIN 651 ESG Investing

- FIN 785 Financial Management

- Featured

- Fiber Foamie

- First Principles

- For Future Reference

- Gig Work

- Goals

- HED315 Drugs and Society

- Ideas

- Investment

- LGBT

- Learn To DJ

- MGMT 788 Management Principles and Organizational Behavior

- Minds, Brains, and Computers

- Open Revenue

- Our-Space

- Permaculture

- Preparing

- Projects

- RRS280 Race, Gender, and Science Fiction

- Reading List

- Recipes

- Revisit

- School

- Social Media

- Symbolic Logic

- Synthesis

- Tech 2U

- The Levels Challenge: Build 12 Startups in 12 Months

- USP 530 Alternate Urban Futures

- USP493 Data Analysis

- USP514 Sustainable Development

- USP515 Environmental Justice

- Vehicle Design

- YouTube